- Napkin Notes

- Posts

- 💭 Top Reasons VCs Care About Your Startup Idea

💭 Top Reasons VCs Care About Your Startup Idea

The key factors to tell if your startup idea is worth pitching to VCs

Hey Founders,

☕️ Welcome back to our Friday newsletter: where we ask founders to guess how many Kernal logos we hid in our cover photo then send a free Starbucks gift card to the first correct email reply. On your mark, get set, GO!

📰 Latest news: Linda Yaccarino is the new CEO of Twitter. Sam Altman had an AI heart-to-heart with Congress. Vice Media declared bankruptcy. There’s now 13 generative AI unicorns. Longevity startup, NewLimit, just closed a $40m Series A. 87% of you had an amazing Mother’s Day Lunch last weekend. And 43% of you are working on a side project that hasn’t been validated on Kernal yet. Get that done before it’s too late.

Enough appetizers, let’s hit the main course 🍽

✨ Partner of the Week: Zendesk

Wondering how to scale customer service when ChatGPT is all the craze? Meet our besties at Zendesk.

They designed AI solutions for founders to land and manage their first customers. And they believe it’s never too early to talk about customers. Sound up your alley? Give these a skim:

P.S. Founders from Kernal that use our Zendesk for Startups program receive 6 months of free access to Zendesk Suite and Zendesk Sales CRM. Grab your Zendesk discount if you want it.

Dig the newsletter? Spread the word and win some goodies. Everybody’s doing it. And we mean everybody. Like even your intern has more referrals than you.

🍽 Today's Menu:

🚀 How to know if your big idea is venture-fundable?

🛠 Wanna work with the Founder of 99 Designs?

✏️ Startup ideas sweeter than your strawberry daiquiri

🐦 Tweets that’ll stop your scroll

🚀 Is My Startup Idea Venture Backable?

The Bobby Axelrods and Taylor Masons of the real world have 2 burning questions when they see your startup pitch slide into their cold emails:

“If we fund this idea, is the market big enough and the founder smart enough to scale this idea to $100M ARR and $1B in value in 10 years?”

If not, you’re probably not the highest-priority cold email to reply to.

Since Bobby and Taylor are off in Cabo this week, we wanted to break down a great piece Lenny recently wrote about the difference between startups that are

A) Better WITH venture funding vs startups that are

B) better WITHOUT venture funding

Here’s the meat and potatoes facts from the article so you can do your own math to see if your startup idea is worth pitching VCs.

3 VC Strategies To Remember:

💰 Fact 1: “You can build a killer business without going the VC route.”

💰 Fact 2: “A simple rule of thumb for what makes an idea venture-scale is having a path to

$100 million a year in revenue

and hitting $1 billion+ valuation,

in 10 years’ time

If you can hit this scale at this timeline, it’s an interesting opportunity that makes VCs (and their investors) like the economics of getting involved

💰 Fact 3: if this timeline/revenue threshold doesn’t align, it’s totally okay and you can still build a great business, it’s just probably not something VCs will be excited about and that’s important for founders to keep in mind when pitching

Lenny suggests 3 factors to gauge venture-scaliness of an idea:

🚀 Is there a large enough market? Is there enough consumers or companies you can monetize off to make $100M ARR and $1B ARR in the future? Thus, the TAM is usually $5B or more.

🚀 Is it a scalable business model? Can you as the founder scale the business via tech vs only hiring people or acquiring assets? This keeps the business high margin and lucrative for investors.

🚀 Is the growth plan clear? Can you show a 2-3x growth YoY and is it sustainable?

Clear growth trajectory with added cash: If people cut a check is there a clear understanding of how it’ll scale the company?

Path to IPO: the startup should plan to go public one day

So there you go. Those are the factors VCs and Angel Investors care about if you’re going to raise venture funding for your business.

If you don’t raise funding, you’re are also in a great spot. Don’t think you need millions of dollars in funding to go build your startup idea. Both paths work, it just depends on the market appetite for your startup idea.

Thanks again to Lenny for crafting this timely post we could share with our builders.

🛠 Wanna Join the Founder of 99 Designs?

Meet Matt, the founder of 99designs, Flipa, an avid angel investor and former CRO at Unstoppable Domains.

The TL;DR: He’s looking to hire an Operator and sent us a message to spread the word. We thought it’d be a pretty cool opportunity for one of you opening today’s email so if it piques your interest, skim the full job description here.

Why this is cool: His website (https://sitepoint.run/) has 13M visitors annually, 17,000 paying subscribers, 495,000 newsletter subscribers, 168,000 pages indexed in Google, 64,500 referring domains, 10.8 million backlinks and a domain authority of 87.

Side note: he’s offering equity for the right person. So this ain’t no small-time Starbucks barista gig.

He wants:

an operator with hustle, entrepreneurial drive and risk-taking mindset

someone who runs the business like it’s their own and is motivated by uncapped profit share + equity.

a candidate that’s been a founder of a SaaS product but couldn't find PMF and wants another shot with a massive distribution advantage.

Sound interesting? Apply here and tell Matt the Kernal fam sent you.

Now, the main course you’ve all been waiting for…

✨Fresh Startup Ideas ✨

We all know the pain… This idea could be a gem.

Hit up Daniel if you like the idea to see where he’s at with building it out.

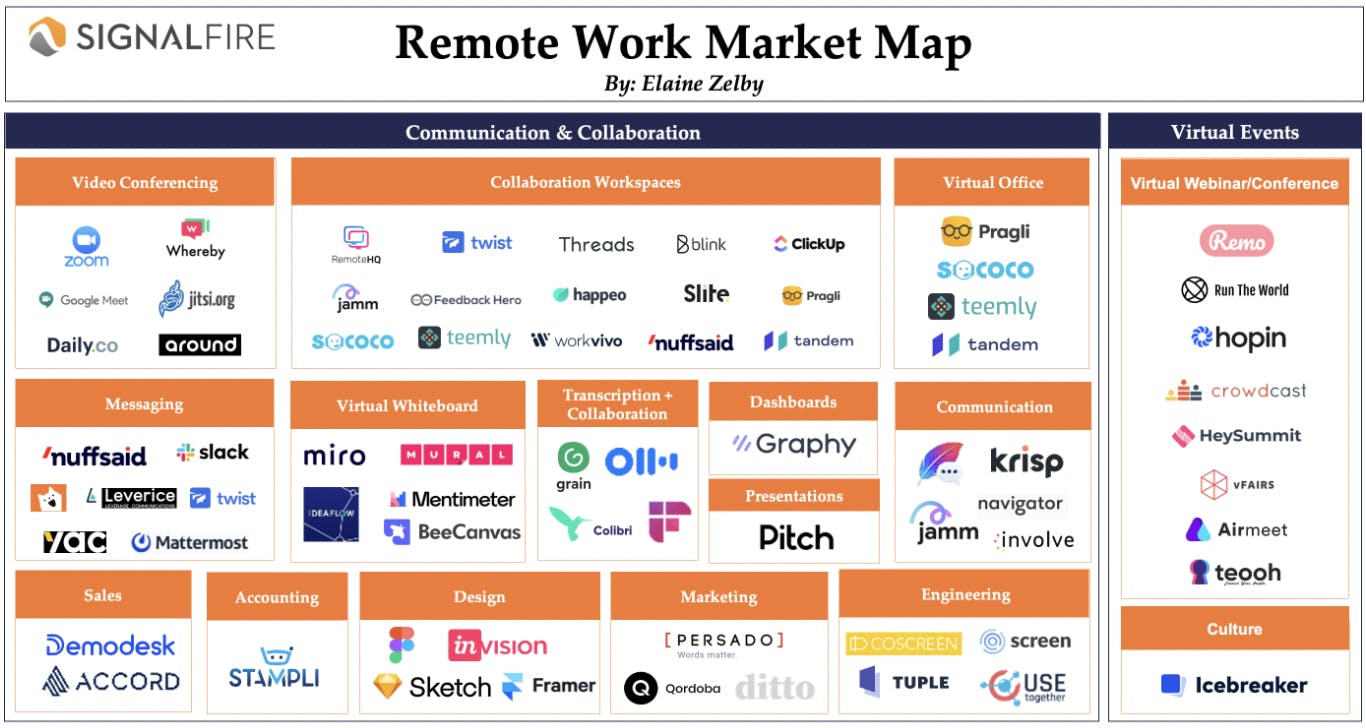

Imagine a product that can convert a Google Sheet or Airtable into a visual market map, similar to what Glide does for Google Sheets.

Could be a mobile app, a plugin, a Chat GPT spin-off.

Vote by tapping below if it’s something you’d use.

Side note: a little while ago, Peter Shi, spun up a Gumroad solution for an MVP. Check it out here

The product brain of Paul Burke, who posted this idea, says this platform contains elements of Reddit, GoFundMe, Substack and Patreon.

What do you think?

If you think it’s got legs, share if you’d help build, buy or invest in the idea below?

Got a startup idea of your own?

Quit watching talks by TED and start gettin’ that bread.

Smash the button below.

Founder Flags Worth Reading:

✏️ Make Me Like James Clear: 5 Writing Tools Every First-Time Founder Needs in Their Toolkit

🎓 Good, Morning Class: TheyGotAcquired just launched their first course

🧪 Beta this, beta that: Herve has 8 customers ready to join his beta plan

🔑 We got a Major Key: Steal this library of 4,000+ AI tools

💡 Bring me back to the good ol’ days: this is a great Early Days interview with Artem and how he built Twool

✈️ IRL conference worth going to: All In Podcast Summit is happening in Sept if you wanna go

👋 A match made in heaven: How to know if it’s the right co-founder

✏️ To love AI or to not love AI: 20VC: Meta Chief AI Scientist on Why AI Will Not Dominate Humanity & Why No Economists Believe All Jobs Will Be Replaced by AI

🐦 Tweets of the Week

Enough startup vibes.

Go have an 11/10 weekend.

💚 The Kernal Fam

Remember: share the newsletter and good things will happen.

Rank today's newsletter 👇If you read this far, cast a vote. It means more than you know. |

Join the conversation